How Financial Apps Help Track Monthly Expenses More Easily

Tracking monthly expenses is a fundamental part of responsible financial management. However, many people struggle to monitor their spending consistently due to lack of organization, time constraints, or unclear financial habits. Fortunately, financial apps have transformed the way individuals track expenses by making the process simpler, faster, and more structured.

Moreover, financial apps reduce the complexity traditionally associated with expense tracking. Instead of manually writing down every transaction, users can rely on digital tools that organize information automatically. As a result, monthly expense tracking becomes more accessible and less stressful for everyday users.

This article explains how financial apps help track monthly expenses more easily, why they improve money awareness, and how they support healthier financial routines over time.

Understanding Monthly Expense Tracking

Monthly expense tracking involves recording and reviewing all spending activities within a defined period. Essentially, this process allows individuals to understand where their money goes and how spending aligns with income.

Additionally, tracking expenses highlights spending habits that may otherwise remain unnoticed. For example, small recurring purchases can accumulate into significant monthly costs. Therefore, understanding these patterns is essential for better financial planning.

Financial apps simplify this process by centralizing expense data. Consequently, users no longer need multiple tools or fragmented records.

Why Tracking Monthly Expenses Is Often Difficult

Despite its importance, expense tracking presents several challenges for many people.

Lack of Consistency

First, many individuals forget to record expenses regularly. Without reminders or automation, manual tracking becomes inconsistent. As a result, financial records quickly lose accuracy.

Complexity of Manual Methods

Traditional methods, such as spreadsheets or notebooks, require effort and discipline. Consequently, users may abandon these systems after a short period.

Limited Financial Awareness

Without clear summaries, people struggle to interpret raw numbers. Therefore, understanding spending behavior becomes difficult without visual support.

Financial apps address these challenges by offering automated, user-friendly solutions that simplify expense tracking significantly.

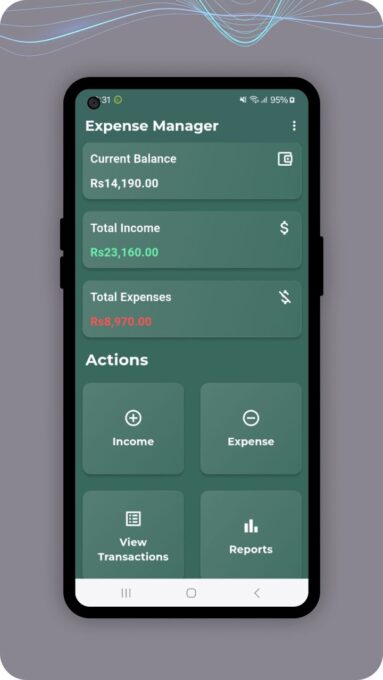

How Financial Apps Simplify Monthly Expense Tracking

Financial apps are designed to reduce friction in financial management. Therefore, they include features that streamline the tracking process from start to finish.

Automated Transaction Recording

One of the most valuable features of financial apps is automated transaction recording. By capturing expenses digitally, users no longer need to log purchases manually. As a result, tracking becomes faster and more reliable.

This automation supports monthly expense tracking by ensuring that transactions are recorded consistently and accurately.

Categorized Spending Overview

Financial apps categorize expenses into groups such as food, transportation, utilities, and entertainment. Consequently, users can instantly see how money is distributed across different areas.

This categorization improves expense organization and helps identify areas of overspending.

Real-Time Expense Updates

Instead of waiting until the end of the month, financial apps update expenses in real time. Therefore, users always know their current spending status.

Real-time updates support daily money tracking, which strengthens financial awareness throughout the month.

The Role of Visual Tools in Expense Tracking

Visual elements play a critical role in helping users understand financial data.

Charts and Graphs

Most financial apps include charts and graphs that display spending patterns clearly. As a result, users can interpret complex data quickly without detailed analysis.

These visuals support spending analysis by turning numbers into understandable insights.

Monthly Summaries

Monthly summaries provide a complete overview of income and expenses. Therefore, users can review performance at the end of each month and adjust habits accordingly.

This feature strengthens monthly budget review practices.

How Financial Apps Improve Spending Awareness

Spending awareness refers to understanding how financial decisions impact overall stability. Financial apps enhance this awareness in several ways.

Immediate Feedback on Spending

When users see expenses recorded immediately, they become more mindful of purchases. Consequently, impulse spending often decreases.

This immediate feedback supports financial awareness tools that promote better decision-making.

Clear Spending Limits

Many financial apps allow users to set spending limits for specific categories. As a result, users receive alerts when approaching limits.

These alerts support budget monitoring without requiring constant attention.

Building Better Financial Habits Through Apps

Beyond tracking, financial apps encourage long-term habit formation.

Encouraging Regular Reviews

Apps often prompt users to review spending weekly or monthly. Therefore, financial reviews become part of a routine rather than an occasional task.

This routine strengthens personal finance habits over time.

Supporting Accountability

Seeing clear spending data encourages accountability. Consequently, users are more likely to stick to budgets and financial plans.

Accountability improves financial self-management significantly.

Types of Financial Apps Used for Expense Tracking

Different financial apps cater to different user needs. Understanding these types helps users choose suitable tools.

Manual Entry Apps

Manual entry apps require users to input expenses themselves. Although they require effort, they increase spending awareness by encouraging reflection.

These apps support intentional expense tracking.

Automated Tracking Apps

Automated apps record expenses automatically. Therefore, they are ideal for users who prefer convenience and consistency.

These tools enhance automated financial tracking.

Hybrid Apps

Hybrid apps combine manual and automated features. As a result, users maintain control while benefiting from automation.

Hybrid systems support flexible expense management.

Benefits of Using Financial Apps for Monthly Expense Tracking

Financial apps offer numerous benefits that improve financial organization.

- Clear overview of spending

- Reduced manual effort

- Improved consistency

- Better financial visibility

- Enhanced planning accuracy

Because of these benefits, financial apps are widely used for monthly spending control.

Common Challenges When Using Financial Apps

Although financial apps are effective, users may encounter challenges.

Learning Curve

Some apps require time to understand fully. However, tutorials often ease this transition.

Overreliance on Automation

Automation can reduce engagement if users stop reviewing data. Therefore, regular reviews remain essential.

Data Interpretation

Understanding reports requires basic financial knowledge. Over time, users naturally develop this skill.

How to Use Financial Apps Effectively for Expense Tracking

Using financial apps effectively requires consistent engagement.

Set Clear Categories

Customizing categories ensures accurate tracking. Therefore, users should align categories with personal spending habits.

Review Expenses Regularly

Frequent reviews improve accuracy and awareness. As a result, users stay informed throughout the month.

Adjust Budgets as Needed

Financial situations change. Therefore, adjusting budgets ensures realistic planning.

These practices support effective expense management.

Financial Apps and Household Expense Tracking

Financial apps also support shared expense tracking within households.

Shared Visibility

Shared access improves transparency. Consequently, family members stay aligned on spending decisions.

Coordinated Planning

Shared data supports coordinated budgeting. Therefore, households manage expenses more efficiently.

This approach strengthens household financial organization.

The Long-Term Impact of Tracking Monthly Expenses Digitally

Consistent digital tracking creates long-term benefits.

Improved Financial Confidence

Understanding spending builds confidence. As a result, users feel more in control of their finances.

Better Decision-Making

Clear data supports informed decisions. Therefore, users plan expenses more effectively.

Reduced Financial Stress

Clarity reduces uncertainty. Consequently, financial stress decreases over time.

These outcomes highlight the value of digital expense tracking tools.

Future Developments in Expense Tracking Apps

Financial apps continue to evolve as technology advances.

Smarter Expense Categorization

Improved algorithms will enhance accuracy. Therefore, users will spend less time correcting data.

Personalized Insights

Apps will offer more personalized insights. As a result, financial guidance becomes more relevant.

Enhanced User Experience

Simplified interfaces will improve accessibility. Consequently, more users will benefit from financial apps.

Conclusion

Financial apps play a crucial role in helping individuals track monthly expenses more easily. By automating data collection, organizing spending categories, and providing clear visual insights, these tools simplify everyday financial management.

Moreover, financial apps encourage consistent habits, improve spending awareness, and support long-term financial stability. When used effectively, they transform expense tracking from a difficult task into a manageable routine.

Ultimately, financial apps empower users to understand their finances clearly and make informed decisions with confidence.